You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AMD quer comprar a Xilinx por 30 mil milhões

- Autor do tópico Torak

- Data Início

A Xilinx "apresentou" o Versal AI, que só estará disponível daqui a um ano...

e anunciou a aquisição de uma empresa basicamente de SW que será integrada na SW suite da própria XIlinx a Vitis

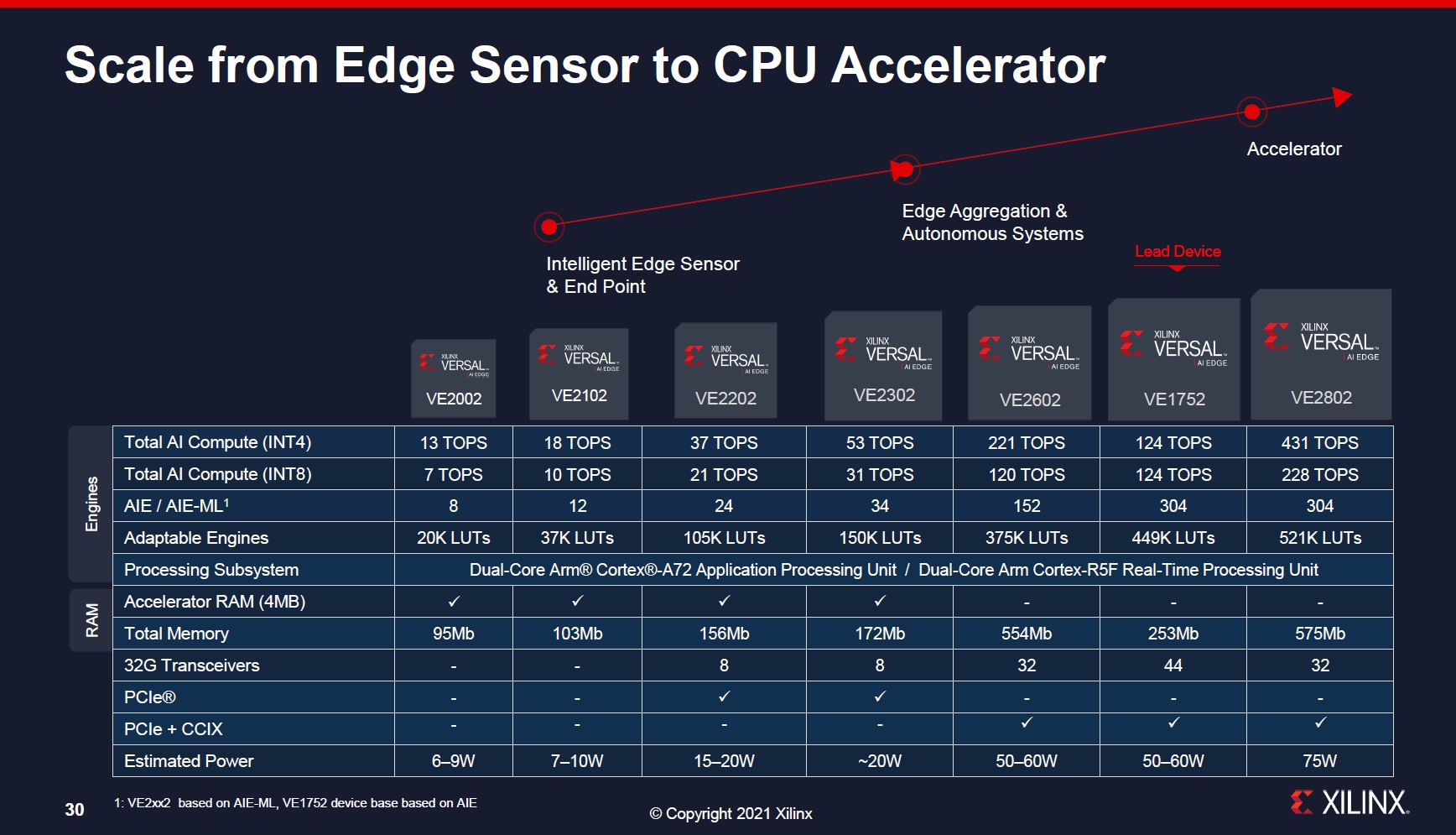

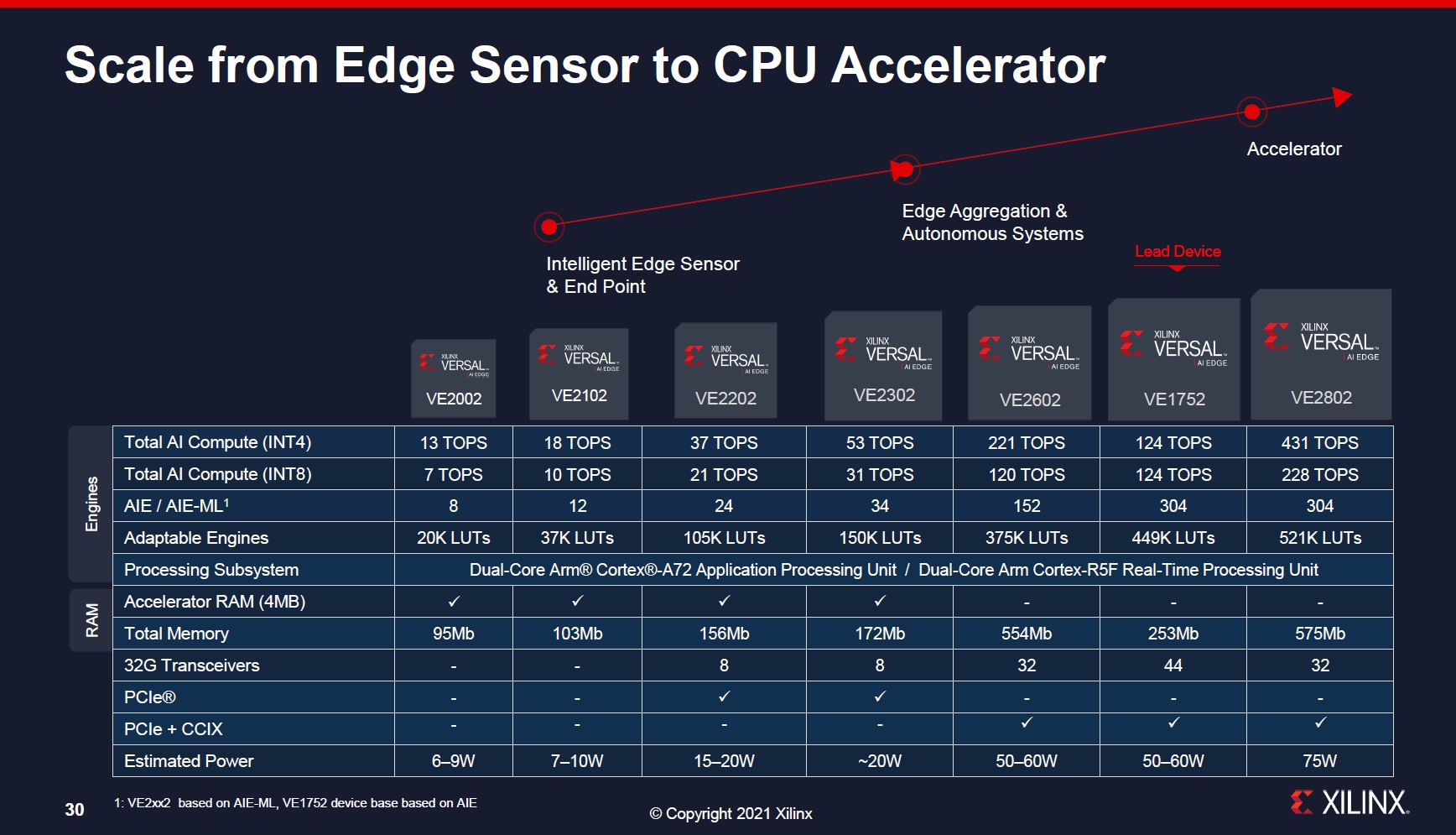

https://www.servethehome.com/xilinx-versal-ai-edge-launched-a-year-early/We started this piece by highlighting how there was an enormous gap, perhaps half a generation, between announcement and availability. Xilinx says that you can purchase its $11,995 development board now and start prototyping using the Versal AI Core then migrate to its AI Edge product next year. In comparison, the NVIDIA AGX Xavier developer kit is $700 (Amazon Affiliate Link) and there is a history of being able to develop on CUDA and upgrade to new hardware.

Xilinx Expands Versal AI to the Edge: Helping Solve the Silicon Shortage

https://www.anandtech.com/show/1675...o-the-edge-helping-solve-the-silicon-shortagee anunciou a aquisição de uma empresa basicamente de SW que será integrada na SW suite da própria XIlinx a Vitis

Xilinx Acquires Silexica to Broaden its Developer Base

Xilinx, Inc., a leader in adaptive computing, today announced that it has acquired Silexica, a privately-held provider of C/C++ programming and analysis tools. Silexica’s SLX FPGA tool suite empowers developers with a development experience building applications on FPGAs and Adaptive SoCs. This technology will become integrated with the Xilinx Vitis unified software platform to substantially reduce the learning curve for software developers building sophisticated applications on Xilinx technology.

https://www.hpcwire.com/off-the-wire/xilinx-acquires-silexica-to-broaden-its-developer-base/After six years of cutting-edge academic research, Silexica was spun out of RWTH Aachen University in 2014. Its headquarters are in Cologne, Germany, with offices in Silicon Valley and Japan. It serves innovative companies in the automotive, robotics, wireless communications, aerospace, and financial industries and has received $28 million in funding from international investors.

Financial details and the terms of the transaction are not being disclosed.

AMD-Xilinx Deal Gains UK, EU Approvals — China’s Decision Still Pending

AMD’s planned acquisition of FPGA maker Xilinx is now in the hands of Chinese regulators after needed antitrust approvals for the $35 billion deal were received from the European Commission (EC) and from the UK government this week.

“These latest approvals follow regulatory approvals from Turkey’s Competition Authority, Taiwan’s Fair Trade Commission (TFTC), Korea’s Fair Trade Commission (KFTC), the Australian Competition and Consumer Commission (ACCC) and the expiration of the waiting period under U.S. [Hart–Scott–Rodino Antitrust Improvements Act of 1976] regulatory laws,” an AMD spokesperson told EnterpriseAI. “This is another important step towards closing our strategic acquisition of Xilinx by the end of this year.”

https://www.hpcwire.com/2021/07/01/...k-eu-approvals-chinas-decision-still-pending/Still to be resolved is the proposed acquisition’s regulatory review and status in China, the spokesperson said. “China is the primary regulatory approval still required. We have filed our transaction with China’s State Administration for Market Regulation (SAMR). We continue working with Chinese regulators and remain on-track for approval by year’s end.”

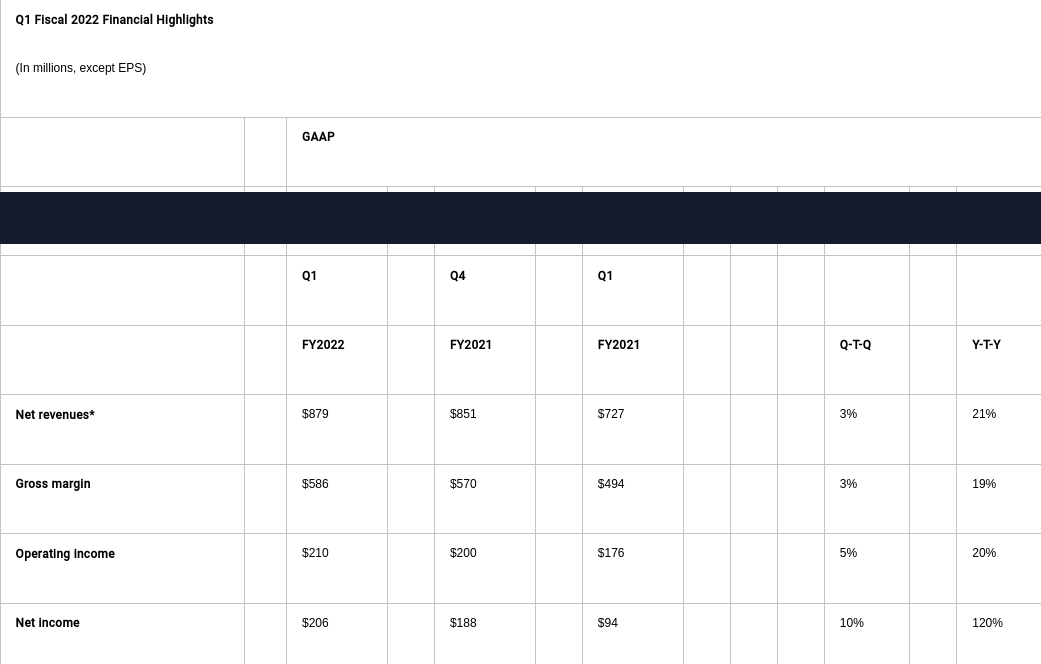

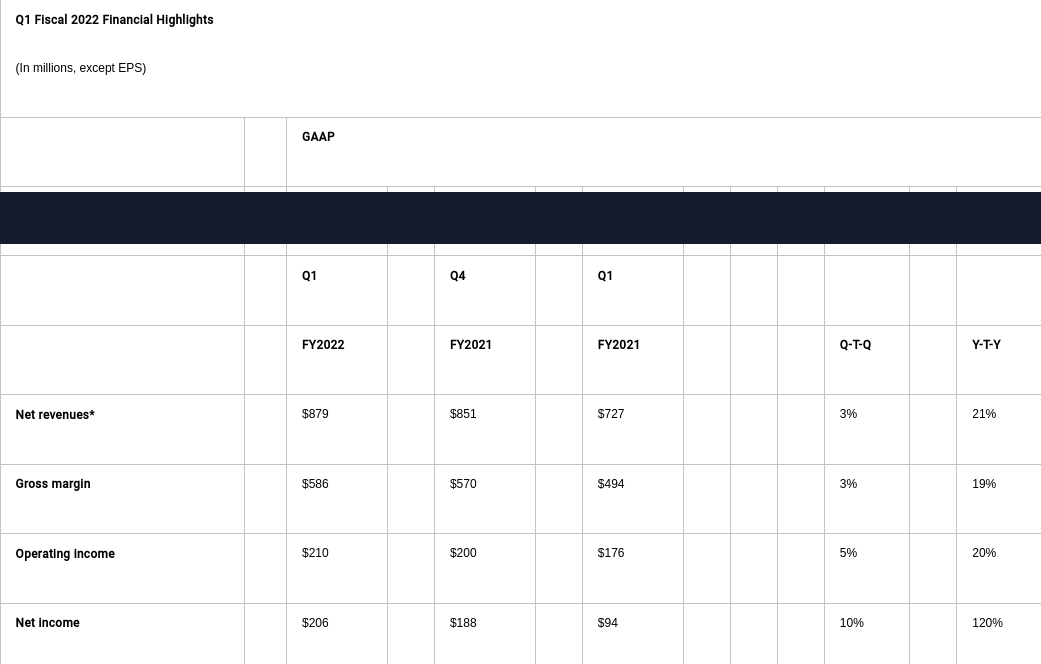

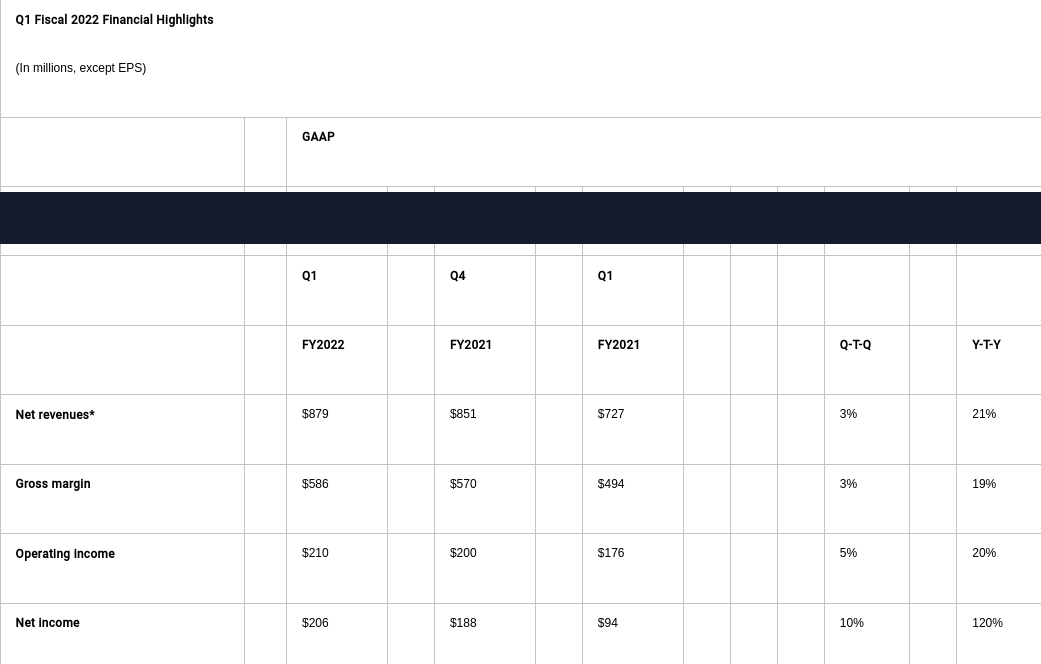

Resultados do trimestre - não me perguntem, é mais ou menos como a Nvidia, os quarters deles não batem certo com o ano civil

https://investor.xilinx.com/news-re...inx-reports-fiscal-first-quarter-2022-results

NOTA:

Q-T-Q é comparação como o Quarter Anterior, neste caso Q4 2021

Y-T-Y é a comparação com o mesmo quarter do ano anterior, neste caso Q1 2021

As percentagens dos End Market nos quarters representa o mercado específico e o peso deste no total do negócio.

Xilinx Reports Fiscal First Quarter 2022 Results

- Record revenue of $879 million, representing 3% sequential growth and 21% annual growth, despite ongoing industry-wide supply chain challenges

- Data Center Group (DCG) revenue in the quarter increased 14% sequentially driven by strong demand across hyperscale cloud customers and the Fintech market

- Wired and Wireless Group (WWG) revenue was up 13% year-over-year and flat sequentially driven by continuing global 5G deployments

- Aerospace & Defense, Industrial and Test, Measurement & Emulation (AIT) revenue declined 10% sequentially, with record Industrial end market performance offset by a decline in Aerospace & Defense sales, and a modest decline in TME

- Automotive, Broadcast and Consumer (ABC) revenue in the quarter increased 13% sequentially, with record quarters in the Broadcast and Consumer end markets

- Platform transformation continues with total Adaptive SoC revenue, which includes Zynq and Versal platforms, up 13% sequentially and 83% year-over-year, and representing 28% of total revenue

- Fiscal first quarter free cash flow of $373 million, representing 42% of revenue

https://investor.xilinx.com/news-re...inx-reports-fiscal-first-quarter-2022-results

NOTA:

Q-T-Q é comparação como o Quarter Anterior, neste caso Q4 2021

Y-T-Y é a comparação com o mesmo quarter do ano anterior, neste caso Q1 2021

As percentagens dos End Market nos quarters representa o mercado específico e o peso deste no total do negócio.

Rafx

Power Member

Se não estou em erro Q4 2020 é referente aos primeiros três meses de 2021 e Q1 2021 aos segundos três meses.Resultados do trimestre - não me perguntem, é mais ou menos como a Nvidia, os quarters deles não batem certo com o ano civil

Xilinx Reports Fiscal First Quarter 2022 Results

https://investor.xilinx.com/news-re...inx-reports-fiscal-first-quarter-2022-results

NOTA:

Q-T-Q é comparação como o Quarter Anterior, neste caso Q4 2021 [emoji2955]

Y-T-Y é a comparação com o mesmo quarter do ano anterior, neste caso Q1 2021 [emoji2955]

As percentagens dos End Market nos quarters representa o mercado específico e o peso deste no total do negócio.

É o 'ano fiscal' da AMD, só começa no segundo trimestre do ano civil, acontece o mesmo com muitas outras empresas.

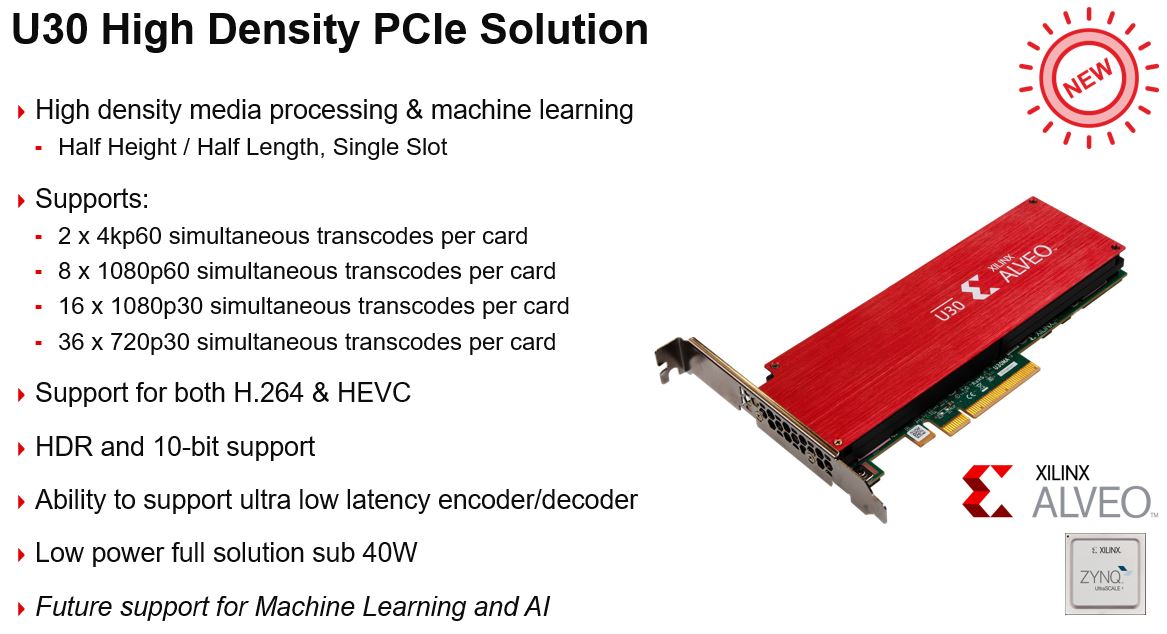

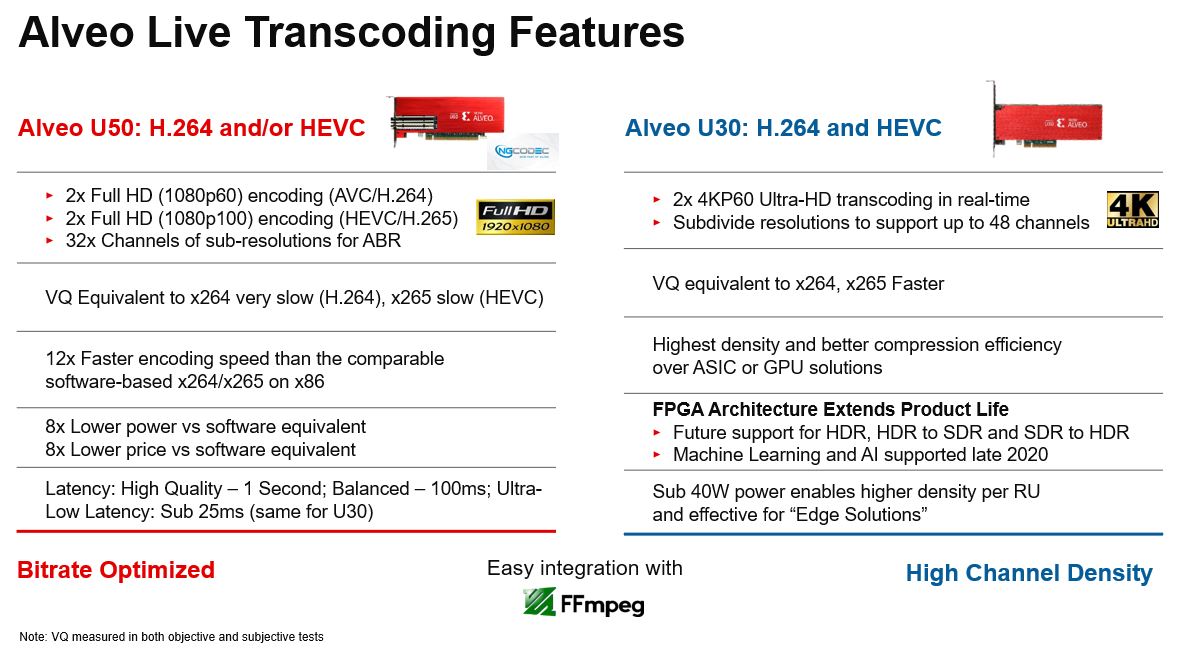

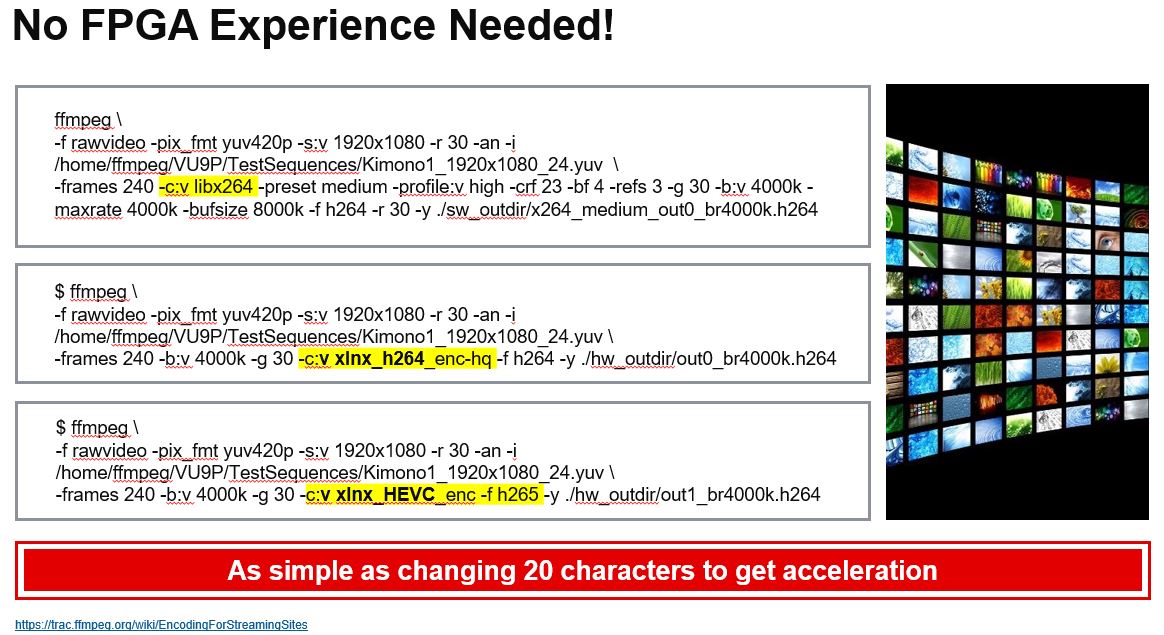

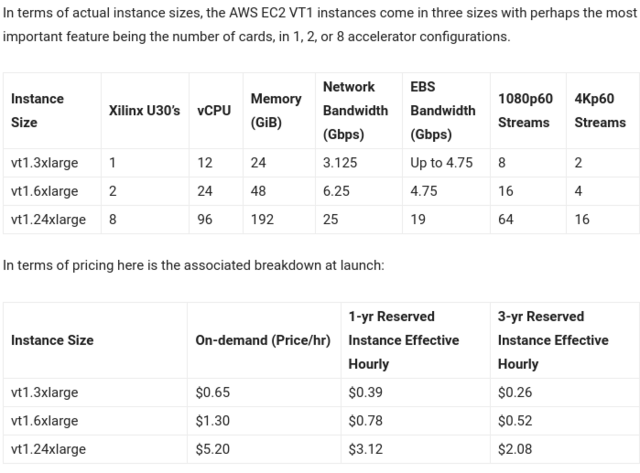

Amazon AWS EC2 VT1 Instances Use Xilinx FPGAs for Video Transcoding

https://www.servethehome.com/amazon-aws-ec2-vt1-instances-use-xilinx-fpgas-for-video-transcoding/AWS has something else that may make folks excited. The company also announced that it will be bringing these Alveo U30 VT1 instance types to AWS Outposts for on-prem deployments. Think of using an outpost for live event streaming via an AWS Outpost as an example. It seems like AWS has bigger plans for the U30 than just its cloud data centers.

Xilinx Reports Record Revenue in Fiscal Second Quarter 2022

https://www.hpcwire.com/off-the-wire/xilinx-reports-record-revenue-in-fiscal-second-quarter-2022/Highlights

- Record revenue of $936 million, representing 7% sequential growth and 22% annual growth amidst continuing industry-wide supply chain challenges

- Aerospace & Defense, Industrial and Test, Measurement & Emulation (AIT) revenue increased 20% sequentially, with strong performance in all sub-markets led by another record performance in the Industrial end market and improvement in Aerospace & Defense business

- Automotive, Broadcast and Consumer (ABC) revenue in the quarter increased 19% sequentially, with record quarters in all sub-markets, led by the Automotive end market

- Wired and Wireless Group (WWG) revenue increased 9% sequentially and 42% year-over-year as robust global 5G deployments continue and strength from the Wired business

- Data Center Group (DCG) revenue declined modestly, down 3% quarter-over-quarter, as Networking strength was offset by a decline in Compute

- Platform transformation continues with total Adaptive SoC revenue, which includes Zynq and Versal platforms, up 9% sequentially and 56% year-over-year, and representing 29% of total revenue

The Accelerated Path To Petabyte-Scale Graph Databases

TigerGraph, the upstart maker of the graph database by the same name, has been working with FPFA maker Xilinx on a new twist on database acceleration and is putting a stake in the ground right here at The Next Platform to deliver petascale graph databases — a tall order because graph databases are notoriously hard to scale — within the next two years.

The Xilinx FPGAs are running a modified Vitus graph analytics library that that does the cosine similarity and top 1,000 scores for similarities — in this case, the workload was looking at healthcare patient records stored in a graph database for similar cases.

There are multiple cards that can be used to accelerate the workload, and these cards are run in parallel fashion now, but eventually there will be interconnects — probably CCIX interconnects and maybe someday after the AMD acquisition of Xilinx is done, Infinity Fabric links — between the FPGAs so they can share data directly,

The benchmark tests that TigerGraph and Xilinx did were performed on ProLiant DL385 Gen10 Plus servers from Hewlett Packard Enterprise, which have a pair of AMD “Milan” Epyc 7713 processors with 64 cores running at 2 GHz. This server had 512 GB of main memory and 60 TB of flash storage, a mix of SATA and NVM-Express devices. The machine was equipped with five Xilinx Alveo U50 cards, which cost $2,500 a pop by the way (reasonably priced compared to some GPU accelerators in the datacenter). The Alveo U50 cards, which we covered here, have 6,000 DSP blocks, 872,000 lookup tables (LUTs), 1.7 million flip-flops, 227 MB of on-chip block RAM, and 8 GB of HBM2 memory with 460 GB/sec of bandwidth; they burn under 75 watts. The system ran Ubuntu Server 20.04.1 LTS and had TigerGraph 3.1 Enterprise Edition loaded along with the Vitis libraries. The test was run against the Synthea synthetic patient dataset.

On a subset of the data with 1.5 million patients and one FPGA turned on and 15 million patients with five FPGAs turned on, here is what the CPU-only and Alveo-boosted response times looked like trying to find the top 1,000 similar patients with the cosine similarity function accelerated on the FPGAs:

https://www.nextplatform.com/2021/10/28/the-accelerated-path-to-petabyte-scale-graph-databases/The CPU-only response time was 430 milliseconds on average to find 1,000 most-alike patients in the 1.5 million patient dataset, and it dropped down to 10 milliseconds with the FPGA accelerating the cosine similarity function. Increasing the dataset size by a factor of 10X to 15 million patients, the CPU-only response time was 1.6 seconds — not great — but was 48X lower at 33 milliseconds with five FPGAs activated.

AMD and Xilinx Provide Update Regarding Expected Timing of Acquisition Close

https://www.amd.com/en/press-releas...e-regarding-expected-timing-acquisition-close“We continue making good progress on the required regulatory approvals to close our transaction. While we had previously expected that we would secure all approvals by the end of 2021, we have not yet completed the process and we now expect the transaction to close in the first quarter of 2022. Our conversations with regulators continue to progress productively, and we expect to secure all required approvals.”

A AMD submeteu hoje um "Form 8-K" à SEC a informar que recebeu a aprovação condicional do regulador Chinês

Item 8.01 Other Events

On January 27, 2022, Advanced Micro Devices, Inc., (“AMD”) and Xilinx, Inc. (“Xilinx”) received clearance from the National Anti-Monopoly Policy Bureau of the

State Administration for Market Regulation of the People’s Republic of China with respect to the merger (the “Merger”) of Thrones Merger Sub, Inc., a wholly

owned subsidiary of AMD (“Merger Sub”), with and into Xilinx, with Xilinx surviving the Merger as a wholly owned subsidiary of AMD, pursuant to, and subject to

the terms and conditions set forth in, that certain Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 26, 2020, by and among AMD,

Merger Sub and Xilinx.

https://ir.amd.com/sec-filings/content/0000002488-22-000009/0000002488-22-000009.pdfAMD and Xilinx currently anticipate that the closing of the Merger will occur in the first quarter of 2022, subject to the expiration of the waiting period under the

HSR Act and the satisfaction (or, to the extent permitted by applicable law, waiver) of the conditions set forth in the Merger Agreement that by their nature are to

be satisfied at the closing of the Merger.

Xilinx Works From The Edge Towards Datacenters With Versal FPGA Hybrids

Here is the original Versal roadmap for the six series in the product line, which was put out in the fall of 2018:

And here is the roadmap as of early this year:

Given all that has changed in the world between the Everest preview and today, you would expect for some changes, not just because of foundry and packaging shortages but because of changing market dynamics. Just as an example, if Ethernet switch makers or 5G base station makers use a mix of ASICs and FPGAs to create their appliances, you don’t want the FPGA to be a bottleneck, so you might focus on these lower-end devices where you know you have market demand and push other devices further out on the roadmap. Similarly, if customers can get by with a Virtex UltraScale+ device for now, which is made on a more mature and cheaper process and which might be in stock, you might focus on selling this instead of forcing the Versal upgrade. This is precisely the kind of thing that happened to the Xilinx roadmap, and is happening to the roadmaps of all kinds of compute engines in the datacenter and at the edge.

This table sums up where Xilinx is in terms of sampling and shipping across the Versal series:

https://www.nextplatform.com/2022/0...towards-datacenters-with-versal-fpga-hybrids/

Tem ainda uma parte interessante:

The Versal AI RF Series could be a long time coming, we think, because it is hard to shrink the radio to 7 nanometers and get good signal and power – this is why the memory and I/O hubs in some CPU chiplet architectures are made with the larger transistor processes and the core compute, matrix math, or packet processing engines are shrank to 7 nanometers and then 5 nanometers. We have a hunch – and Xilinx didn’t say anything about this – that the future Versal AI RF series will be a chiplet design that breaks the radio free from the programmable logic and hard-coded logic.

A Xilinx apesar de tudo tembém tem apresentado bons resultados, como quase todas as companhias de semicondutores

Xilinx Reports Record Revenue of $1.01 Billion in Fiscal Third Quarter

https://investor.xilinx.com/news-re...cord-revenue-101-billion-fiscal-third-quarter

- Record revenue of $1,011 million, representing 8% sequential growth and 26% year-over-year growth, despite ongoing industry-wide supply constraints

- Data Center Group (DCG) achieved record revenue with sequential growth of 28% and 81% year-over-year, driven by Compute and Networking strength

- Aerospace & Defense, Industrial and Test, Measurement & Emulation (AIT) revenue was also a record, increasing 21% sequentially and 28% year-over-year, driven by record A&D revenue and continued strength in ISM and TME end markets

- Automotive, Broadcast and Consumer (ABC) revenue in the quarter decreased 4% sequentially coming off a record Q2 and largely in-line with expectations; revenue increased 28% year-over-year

- Wired and Wireless Group (WWG) revenue decreased 18% sequentially and increased 1% year-over-year as supply constraints had a significant impact on business in the quarter

- Platform transformation continues with total Adaptive SoC revenue, which includes Zynq and Versal platforms, up 5% sequentially and 30% year-over-year, and representing 28% of total revenue

e comentário do CEO

“Xilinx achieved another record quarter and surpassed $1 billion in quarterly sales for the first time in the company’s history,” said Victor Peng, Xilinx president and CEO. “While we were unable to fully satisfy customer needs, our results demonstrate our team’s relentless focus and execution in supporting our customers as well as possible given the extremely tight supply conditions.

Como a Xilinx tem o ano alinhado pelo ano fiscal, as contas anuais devem sair em Abril, com as previsões a apontar para valores na ordem dos 3.8$B.

Aparentemente a AMD e Xilinx concordaram com as condições do regulador chinês, e este terá aceite as garantias dadas

que romântico...

que romântico...

As condições também não eram nada de especial, segundo noticiou a Reuters há uns 15 dias atrás

AMD Receives All Necessary Approvals for Proposed Acquisition of Xilinx

https://ir.amd.com/news-events/pres...receives-all-necessary-approvals-for-proposedTransaction expected to close on or about February 14, 2022

SILICON VALLEY, Calif., Feb. 10, 2022 (GLOBE NEWSWIRE) -- AMD (NASDAQ: AMD) today announced that it has received approval from all necessary authorities to proceed with the acquisition of Xilinx, Inc. (NASDAQ: XLNX).With the the exception of the remaining customary closing conditions, all conditions to the transaction closing have been satisfied and the company expects the transaction to close on or about February 14, 2022.

As condições também não eram nada de especial, segundo noticiou a Reuters há uns 15 dias atrás

China conditionally approves AMD's $35 bln deal for Xilinx

https://www.reuters.com/technology/china-conditionally-approves-amds-35-bln-deal-xilinx-2022-01-27/In a public notice, China's State Administration for Market Regulation said it will approve the deal on condition that AMD and Xilinx do not force tie-in sales of products or discriminate against customers that buy one set of products but not another.

The regulator added that the newly merged entity must also ensure "the flexibility and programmability of Xilinx FPGAs" and "that their development methods are compatible with ARM-based processors".

It must also make sure that its GPUs and FPGA products sold to China are interoperable with products in the China market.

Última edição:

Não demorou muito...

https://www.hpcwire.com/2022/03/08/...vidia-with-improved-vck5000-inferencing-card/

EDIT: ah e já me esquecia, outras coisas que se ganham com o negócio

The co-packaged optical (CPO) demonstration system built by Xilinx and Ranovus. It incorporates the former’s Versal ACAP with the latter’s Odin Analog-Drive CPO 2.0. (Source: Ranovus)

AMD/Xilinx Takes Aim at Nvidia with Improved VCK5000 Inferencing Card

AMD/Xilinx has released an improved version of its VCK5000 AI inferencing card along with a series of competitive benchmarks aimed directly at Nvidia’s GPU line. AMD says the new VCK5000 has 3x better performance than earlier versions and delivers 2x TCO over Nvidia T4.

The VCK5000 is available now for $2745 which AMD says is a very competitive price, particularly given “current supply chain issues.”

AMD contends that unlike fixed-architecture GPUs, more flexible FPGA-based systems can be designed for the specific needs of AI models, in particular, the dataflow requirements. This argument is at the heart of AMD’s “solving the dark silicon” problem, which it says is keeping Nvidia GPUs well below 50 percent of the peak TOPS in some workflows.

“What’s different about [the Xilinx approach] is two things. One is our engine. It’s as good as an ASIC, but we also have a little bit of programmability built-in. Within our VLIW cores, there’s also different types of data passing you can do, [for example] you can do broadcasting. But the most important thing is we are attaching FPGA fabric to that basic core. We are cache-less, we don’t even have a cache in the system so there’s no such thing as cache miss. You can create a perfect internal memory [flow] so you can pump the data every clock cycle into the engine. That’s really how you get 100 percent or near 100 percent efficiency out, [by] reducing the data bubble significant.”

https://www.hpcwire.com/2022/03/08/...vidia-with-improved-vck5000-inferencing-card/

EDIT: ah e já me esquecia, outras coisas que se ganham com o negócio

AMD Allies with Ranovus on Data Center Photonics Module

Ranovus Inc. and its customer AMD/Xilinx demonstrated a module that combines the former’s Odin Analog Drive CPO 2.0 and Xilinx’s Versal ACAP operating at 800G. The short story is that this thing should make artificial intelligence (AI) workloads in data centers go a lot faster, without consuming quite so much power as otherwise — and do it (Ranovus contends) for a lot less money.

The co-packaged optical (CPO) demonstration system built by Xilinx and Ranovus. It incorporates the former’s Versal ACAP with the latter’s Odin Analog-Drive CPO 2.0. (Source: Ranovus)

Versal ACAP is Xilinx’s more-than-just-an-FPGA system on a chip (SoC). It incorporates programmable logic, processor cores, interface circuitry, and other support functions. Xilinx calls its Versal an adaptive compute acceleration platform, or ACAP. As the name implies, it’s designed to accelerate workloads with power and flexibility — AI workloads specifically.

Arabzadeh observed that many existing interfaces top out at about 200G. Odin scales from 800Gbps to 3.2Tbps in the same footprint, he explained, due in large part to the company’s ability to embed lasers directly into the silicon substrate of its ICs. Arabzadeh believes his company’s approach is entirely unique, starting with the company’s quantum dot lasers, and moving on to the ability of the module to provide Nx100Gbps PAM4 Optical I/O channels for Ethernet switch and ML/AI silicon in a single packaged assembly.

By integrating the optics into the package using Versal Premium ACAPs, AMD and Ranovus says it is able to drastically reduce power, simplify board routing, and reduce cost.

https://www.eetasia.com/amd-allies-with-ranovus-on-data-center-photonics-module/Ranovus is also controlling costs with its production approach. “Everything is wafer-level,” Arabzadeh said. The company identifies known-good die on the wafer, selects those, and doesn’t have to bother with the rest.

Regarding power, Arabzadeh said the module draws roughly 4 Watts, whereas the electronics that the modules replace draw roughly 14W-17W.

Última edição:

Claro nada que não se esperasse, a AMD não tinha grande dívida, mas a "fusão" com a Xilinx implicava a passagem da divida deles para a nova AMD resultante desse negócio.

De resto ainda deve aumentar outro tanto por causa da aquisição da Pensando por 1.9B$.

Por outro lado as reservas em "cash" são 3x superiores à actual dívida, mais o aumento da facturação não afectará muito os racios.

De resto ainda deve aumentar outro tanto por causa da aquisição da Pensando por 1.9B$.

Por outro lado as reservas em "cash" são 3x superiores à actual dívida, mais o aumento da facturação não afectará muito os racios.

AMD Expands High Performance Compute Fund to Aid Researchers Solving the World’s Toughest Challenges

SANTA CLARA, Calif.06/01/2022

AMD (NASDAQ: AMD) today announced the expansion of its High Performance Compute (HPC) Fund with the addition of 7 petaflops of computing power to assist global researchers working to solve the most demanding challenges facing society today. AMD also announced that the AMD HPC Fund will now integrate Xilinx Heterogeneous Accelerated Compute Clusters (HACC) program, providing researchers with access to AMD EPYC™ processors, AMD Instinct™ accelerators, Xilinx Alveo™ accelerators and Xilinx Versal™ ACAPs to advance research in areas including climate change, health care, transportation, big data and more.

The new contribution brings the total amount of computing capacity donated by AMD to over 20 petaflops with a market value of more than $31 million, as of May 2022. The additional computing resources will build on the AMD COVID-19 HPC Fund that was established in 2020 to provide research institutions with computing resources to accelerate medical research on COVID-19 and other diseases.

To date, AMD has donated computing systems or cloud-based computing capacity to more than 28 institutions across eight countries. Nearly 6,000 researchers have received access to AMD technologies for their projects, resulting in 55 papers published so far on key issues like disparities in COVID-19 vaccination rates by race and ethnicity and improvements in the classification of breast cancer imagery through deep vision techniques.

https://www.amd.com/en/press-releas...e-compute-fund-to-aid-researchers-solving-theAMD will grant cloud-based access to global universities and research institutions with support from leading system partners Supermicro and WEKA.io. Research institutions and universities can apply for the new round of computing power grants by submitting their application here.

Em resumo: a Xilinx vai integrar o seu programa dirigido ao sector (HACC) académico no da AMD expandindo-o.