AMD Ryzen 7 PRO 6850U "Rembrandt" Linux Laptop Benchmarks

Here is the first of several articles looking at the AMD Ryzen 7 PRO 6850U Linux performance using a Lenovo ThinkPad X13 Gen3.

The Ryzen 7 PRO 6850U is 8 cores / 16 threads like the prior Cezanne Ryzen 7 PRO 5850U but now with a 2.7GHz base clock and 4.7GHz maximum boost clock compared to 1.9GHz base clock and 4.4GHz boost clock with the prior generation part. The Ryzen 7 PRO 6850U has a 15 to 28 Watt configurable TDP and this Zen 3+ processor is manufactured on a TSMC 6nm FinFET process compared to TSMC 7nm FinFET with the former Cezanne Zen 3 models.

The Ryzen 7 PRO 6850U also now supports DDR4-4800 / LPDDR5-6400 memory compared to DDR4/LPDDR4 with the Cezanne models. Arguably most exciting with the Ryzen 7 PRO 6850U is the Radeon 680M graphics that are based on RDNA2 rather than the long used Radeon Vega graphics with prior AMD APUs.

My Ryzen 7 PRO 6850U Linux testing has been happening using a Lenovo ThinkPad X13 Gen3 (21CM0001US) that features 16GB of LPDDR5-6400 (soldered) memory, 512GB NVMe PCIe 4.0 SSD, 13.3-inch 1920 x 1200 IPS 300 nit display, and makes use of the integrated Radeon 680M graphics. It's a nice laptop and all basic functionality works out under Linux while more on the laptop itself under Linux will be talked about in the forthcoming ThinkPad X13 Gen 3 Linux review.

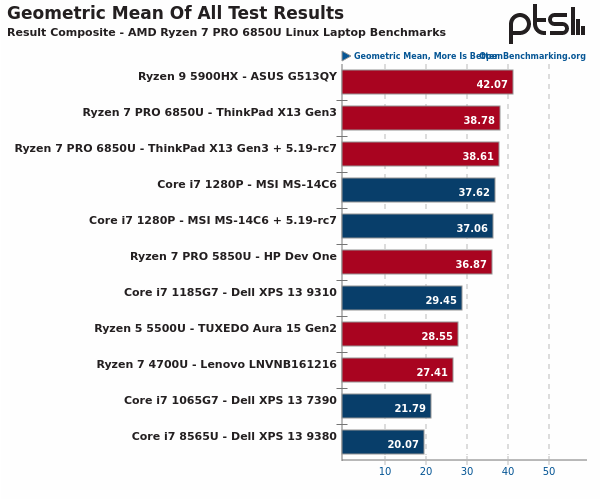

The laptops/processors used for this initial round of AMD Rembrandt Linux benchmarking included:

- Core i7 8565U - Dell XPS 13 9380

- Core i7 1065G7 - Dell XPS 13 7390

- Core i7 1185G7 - Dell XPS 13 9310

- Core i7 1280P - MSI MS-14C6

- Core i7 1280P - MSI MS-14C6 + 5.19-rc7

- Ryzen 7 4700U - Lenovo LNVNB161216

- Ryzen 5 5500U - TUXEDO Aura 15 Gen2

- Ryzen 7 PRO 5850U - HP Dev One

- Ryzen 9 5900HX - ASUS G513QY

- Ryzen 7 PRO 6850U - ThinkPad X13 Gen3

- Ryzen 7 PRO 6850U - ThinkPad X13 Gen3 + 5.19-rc7

All of these laptops were tested on Ubuntu 22.04 LTS using the Linux 5.18 kernel.

Due to seeing improved power efficiency for Alder Lake P with Linux 5.19, the Core i7 1280P was tested both using Linux 5.18 like the other laptops and again with Linux 5.19-rc7. So, similarly, the Ryzen 7 PRO 6850U was tested also with Linux 5.18 and 5.19-rc7.

Across both OpenGL and Vulkan workloads the Radeon 680M graphics were performing very well on the latest open-source drivers. For those interested in the Radeon 680M potential for Linux gaming, a follow-up article will look much more closely at the 680M gaming performance...

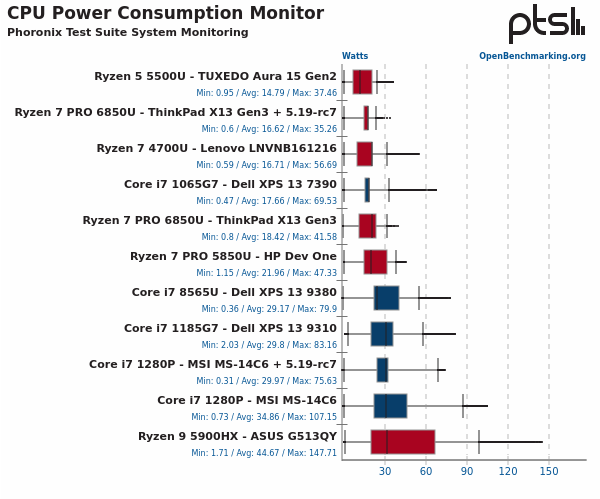

It's with the CPU power consumption where the Ryzen 7 PRO 6850U becomes much more compelling. Above is a look at the CPU power consumption over the entire span of benchmarks conducted. The Ryzen 7 PRO 6850U with the Linux 5.18 kernel had a 18.4 Watt average (or 16.6 Watt average with Linux 5.19 Git) while the Ryzen 7 PRO 5850U average on Linux 5.18 was up at 21.96 Watts. The peak power consumption of the 5850U during testing was 47 Watts compared to 41 Watts with the 6850U or even down to 35 Watts with Linux 5.19 Meanwhile the Core i7 1280P had a 35 Watt average on Linux 5.18 and a peak of 107 Watts... It's with Linux 5.19 Git where the Intel Idle driver support is there that Alder Lake looks better in the power efficiency department but still behind the Zen 3/3+ parts tested. On Linux 5.19 the i7-1280P had a 30 Watt average and a peak of 75 Watts.

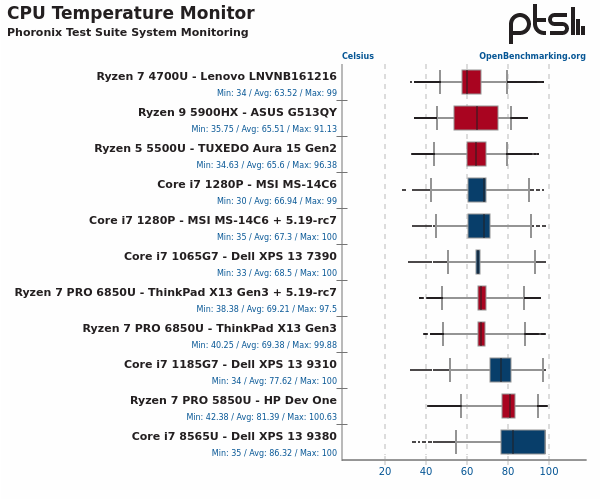

https://www.phoronix.com/scan.php?page=article&item=amd-ryzen7-6850u&num=1The Ryzen 7 PRO 6850U CPU core temperature in the ThinkPad X13 Gen3 during the entire span of benchmarks was 69 degrees compared to the 5850U having an average of 81 degrees. The Core i7 1280P in the MSI Evo notebook had an average core temperature of about 67 degrees.

The AMD Ryzen 7 PRO 6850U in most benchmarks was only slightly faster than the Ryzen 7 PRO 5850U, but its power efficiency with Zen 3+ tended to be much better. It was a nice improvement in performance-per-Watt with Rembrandt and further extends the AMD power efficiency wins over Intel Alder Lake P.