Stellantis scraps digital speedometers for Peugeot car in chips shortage

Carmaker Stellantis

(STLA.MI) said on Wednesday it would replace digital speedometers with more old-fashioned analogue ones in one of its Peugeot models, in a fallout from a global shortage of semiconductor chips that is roiling the auto industry.

The change will only affect Peugeot 308 cars, among group brands that include Chrysler, Citroen and Jeep since France's PSA Group merged with Italian-American company Fiat-Chrysler this year to form Stellantis.

"It's a nifty and agile way of getting around a real hurdle for car production, until the 'chips' crisis ends," a spokesman for Stellantis told Reuters.

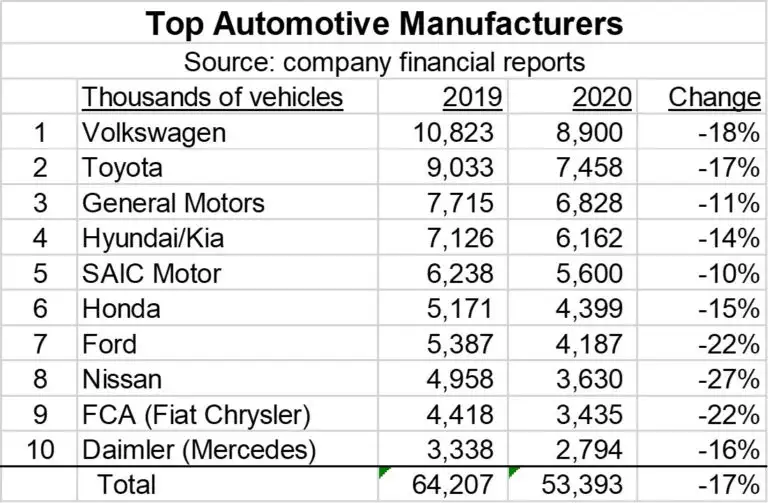

Manufacturing of Peugeot 308 cars had already been disrupted at the group's French factory of Sochaux due to the shortage, echoing temporary halts and production cutbacks globally, from Ford Motor to Volkswagen, in recent months.

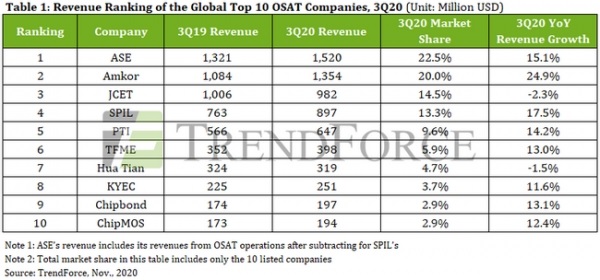

The COVID-19 pandemic drove up demand for semiconductor chips for use in electronics like computers, as people worked from home, and suppliers are struggling to adjust.

The traditional speedometers on Peugeot 308 cars should start appearing in vehicles by the end of May, the company said, while Stellantis is keeping chips for digital dashboards on its most popular models, like the Peugeot 3008 SUV.