blaster_00

Power Member

silício é um material muito abundante, é só uma questão de ter as fábricas. Nos EUA até fecharam por falta de clientes nos semicondutores e solar fotovoltaico, é preciso uma escala mínima...

silício é um material muito abundante, é só uma questão de ter as fábricas. Nos EUA até fecharam por falta de clientes nos semicondutores e solar fotovoltaico, é preciso uma escala mínima...

Today, buyers of silicon wafers of many types face tight supply with rising average selling prices. “Moreover, major wafer suppliers cannot significantly increase the wafer supply due to limited cleanroom space, which could further support the 2022 wafer price trends,” Yoon said. “Also, additional LTA (long-term agreement) prices are needed for new foundry and memory fabs that will come online in the next two years.”

In the silicon wafer business, especially during boom times, customers sign LTAs to ensure they have a long-term stable supply of wafers.

https://semiengineering.com/more-shortages-seen-for-silicon-wafers/Building new wafer capacity is risky. If vendors build too much capacity, they end up in a nightmarish position of having overcapacity and falling prices. But not building capacity is also problematic—a vendor could lose business.

https://www.dramexchange.com/WeeklyResearch/Post/2/11142.htmlMarket leaders ASE and Amkor registered revenues of US$2.15 billion and US$1.68 billion, which represent YoY increases of 41.3% and 24.2%, respectively, for 3Q21. While both companies had some of their capacities hindered due to the shortage of chips, lead frames, and substrates, ASE had its lead times further extended given that its Suzhou-based fab was affected by China’s power rationing.

The semiconductor industry is dealing with a debilitating global chip shortage that began in 2020 and will likely persist into 2023. The wide-ranging crisis has cost the automotive sector an estimated $210 billion in lost revenue. However, market watchers have noted that increasingly constrained quantities of Ajinomoto build-up film (ABF) substrate, a material critical to component manufacturing, could exacerbate the situation.

The key resource has been in short supply throughout 2021, which has restricted the fabrication of many popular integrated circuits (ICs). Analysts expect the gap between ABF substrate demand and supply to worsen next year, raising prices and disrupting availability.

Today, ABF enables the functionality of powerful server processors, networking ICs, laptop and desktop chipsets, and self-driven vehicle systems. Consequently, manufacturers significantly ramped up their material orders to make electronic devices needed to facilitate life in the post-coronavirus pandemic world. Indeed, research group Omdia found sales of ABF substrate bolstered microprocessors reached $66.3 billion in 2020, up 12.56 percent year-over-year.

https://www.sourcengine.com/blog/wo...could-extend-global-chip-shortage-beyond-2023Unfortunately, the ABF substrate manufacturing sector did not have the production capacity to meet the post-COVID-19 demand surge. The field suffered financially in late 2000 as consumers shifted from laptops to smartphones as their primary electronic devices. As such, industry leaders have declined to invest in new factories since then for fear of a protracted market slump.

The supply and demand imbalance for the material has caused major headaches for the world’s top chipmakers.

The cost of ABF substrate, usually quoted per chip, starts at about 50 cents a chip and tops $20 for premium server CPUs.

Major semiconductors companies like Intel, AMD and Nvidia now all depend on ABF substrates to produce the most powerful chips in the world. But substrate makers have been reluctant to invest aggressively in capacity because of money-losing slumps in the past.

https://fortune.com/2021/09/16/chip-shortage-supplier-component-abf-substrate-shares/Some customers are taking matters into their own hands. AMD Chief Executive Officer Lisa Su told analysts in April that the chipmaker would put its own money into increasing capacity at suppliers.

“On the substrate side, in particular, I think there has been under-investment in the industry,” she said. “And so we’ve taken the opportunity to invest in some substrate capacity dedicated to AMD, and that will be something that we continue to do going forward.”

AMD Chief Executive Officer Lisa Su told analysts in April that the chipmaker would put its own money into increasing capacity at suppliers.

“On the substrate side, in particular, I think there has been under-investment in the industry,” she said. “And so we’ve taken the opportunity to invest in some substrate capacity dedicated to AMD, and that will be something that we continue to do going forward.”

DALLAS, June 30, 2021 /PRNewswire/ -- Texas Instruments Incorporated (TI) (Nasdaq: TXN) today announced it signed an agreement to acquire Micron Technology’s 300-mm semiconductor factory (or "fab") in Lehi, Utah, for $900 million

In addition to its value as a 300-mm fab, the acquisition is a strategic move, as Lehi will start with 65-nm and 45-nm production for TI’s analog and embedded processing products and be able to go beyond those nodes as required.

https://news.ti.com/ti-to-acquire-m...st-advantage-and-greater-control-supply-chainRelated underutilization costs of about $75 million per quarter are expected in 2022. First revenue is expected in early 2023.

Samsung took the lead in 2021 with a strong DRAM and NAND flash market performance at the expense of Intel’s relatively flattish results. Major smartphone SoC and GPU vendors also enjoyed strong growth in the year with over 50% YoY revenue increase. In addition, we saw 27% YoY revenue growth among the top 15 vendors, outperforming global semiconductor revenue growth and implying another year of centralized semiconductor industry.

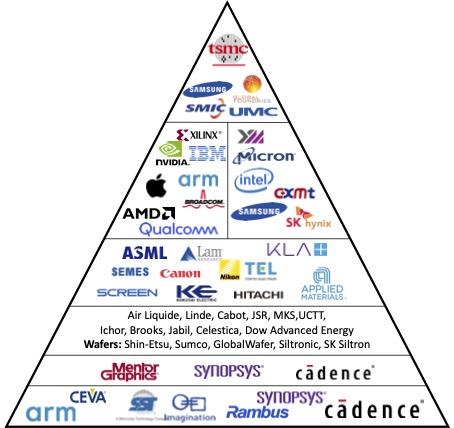

The semiconductor industry has seven different types of companies. Each of these distinct industry segments feeds its resources up the value chain to the next until finally a chip factory (a “Fab”) has all the designs, equipment, and materials necessary to manufacture a chip. Taken from the bottom up these semiconductor industry segments are:

The following sections below provide more detail about each of these seven semiconductor industry segments.

- Chip Intellectual Property (IP) Cores

- Electronic Design Automation (EDA) Tools

- Specialized Materials

- Wafer Fab Equipment (WFE)

- “Fabless” Chip Companies

- Integrated Device Manufacturers (IDMs)

- Chip Foundries

https://semiwiki.com/semiconductor-manufacturers/307494-the-semiconductor-ecosystem-explained/

- As chips have become denser (with trillions of transistors on a single wafer) the cost of building fabs have skyrocketed – now >$10 billion for one chip factory

- One reason is that the cost of the equipment needed to make the chips has skyrocketed

- Just one advanced lithography machine from ASML, a Dutch company, costs $150 million

- There are ~500+ machines in a fab (not all as expensive as ASML)

- The fab building is incredibly complex. The clean room where the chips are made is just the tip of the iceberg of a complex set of plumbing feeding gases, power, liquids all at the right time and temperature into the wafer fab equipment

- The multi-billion-dollar cost of staying at the leading edge has meant most companies have dropped out. In 2001 there were 17 companies making the most advanced chips. Today there are only two – Samsung in Korea and TSMC in Taiwan.

- Given that China believes Taiwan is a province of China this could be problematic for the West.

https://www.cnbc.com/2022/02/01/glo...ic-fails-amid-tech-sovereignty-concerns-.html

- Germany’s Economic Ministry did not clear the 4.35 billion euro ($4.9 billion) deal by the Jan. 31 deadline, meaning the proposed acquisition can’t go ahead as planned.

- The failed takeover comes as nations look to bolster their “tech sovereignty” so that they don’t have to be as reliant on other countries for critical technologies like semiconductors.

- The takeover would have created the second-biggest maker of 300-millimeter wafers behind Japan’s Shin-Etsu.

The plans include spending NT$100 billion (US$3.59 billion) on capacity expansion from 2022-2024, the company said during an online conference that day.

https://focustaiwan.tw/business/202202060011GlobalWafers is considering a number of brown and greenfield capacity expansion plans, including 12-inch (300mm) wafers and epitaxial wafers, 8" and 12" silicon on insulator wafers (SOI), as well as 8" float-zone wafers (FZ), silicon carbide (SiC) wafers (including SiC Epi) and gallium nitride on silicon wafers (GaN on Si), as well as other large-size next-generation products, according to the company.

Espero que agora com os 11.000 milhões que vão dar, aqui a "minha" amkor PT cresça!Yep, se bem que que as Foundries também têm esses serviços.

Já agora à dias, e numa pirueta digna de um artista do Cirque du Soleil, a Alemanha bloqueou a compra da Siltronic pela GlobalWafers (Taiwan).

Germany scuttles $5 billion chip deal with Taiwan firm amid tech sovereignty concerns

https://www.cnbc.com/2022/02/01/glo...ic-fails-amid-tech-sovereignty-concerns-.html

e entretanto a Globalwafers activou o plano B

GlobalWafers unveils expansion plans after bid for Siltronic fails

https://focustaiwan.tw/business/202202060011

Company Participants

Lynn Antipas Tyson - Executive Director of Investor Relations

Jim Farley - President & Chief Executive Officer

John Lawler - Chief Financial Officer

Marion Harris - Chief Executive Officer, Ford Credit

Dan Levy

Hi. Thank you. It’s Dan Levy with Credit Suisse. I'd like to ask about your JV with GlobalFoundries, and just broadly about what you're trying to do with electronic components and sort of the notion of simplification, which you've talked more about. So we've heard that with GlobalFoundries, I think, Hau Thai-Tang mentioned, you'd like to control more of the sub-sourcing to suppliers. You'd like to dictate more of the design of some of the electronic products that in the past have been handled by the suppliers. Maybe you could help us unpack this.

https://seekingalpha.com/article/44...y-on-q4-2021-results-earnings-call-transcriptJim Farley

Thank you for your question. Perhaps the biggest gift for all the pain we're going through now in semiconductors is that we have very painfully learned the lesson that we cannot manage the supply chain for these key components as we have.

In fact you could argue that in the change of transition to these digital electric vehicles that supply chain could be one of the biggest advantages a particular company has or doesn't have. The way we look at it is the key electric components memory chips semiconductors. I would break semiconductors into two types. I'll come back with GlobalFoundries in a second. Feature-rich chips that we still use a lot. A window regulator doesn't need to have a 4-nanometer chip. And the advance -- but we also have sensors power electronics for our inverters, the batteries themselves all the way back to the mine, the inverters of different battery. Chemistries itself have different raw materials and kind of ecosystems that support them.

So this is a very important topic for the company. How different it is? It's really different. We need different talent at the company. We need physical inspection of the actual producers. We need direct contracts with them. We need to design the SoC ourselves. We need to direct in the case -- in some cases to even direct prefer build to print or actually use supplier XYZ to get out of where we've been. And this takes talent. It takes a different approach. It takes more resources.

On GlobalFoundries, it's kind of the first big bet, but there'll be many, many more coming for us. We're very dependent on TSMC for our feature-rich nodes. Obviously, the capacity is at risk over time as the industry moves to more advanced nodes including us.

And as I said we're going to need feature-rich nodes for many years to come. GlobalFoundries knows how to build them. They know to build them in the United States. We can partner with the government depending on the CHIPS Act to capacitize here. It will be a few years until we benefit from that but it's a really big thing to descale ourselves on the feature-rich chips from the current ecosystem that we depend on around the world. And I think GlobalFoundries is a really interesting deal when we get into the details.

United Microelectronics Corporation (NYSE: UMC; TWSE: 2303) (“UMC” or “The Company”), a leading global semiconductor foundry, today announced that its Board of Directors has approved a plan to build a new advanced manufacturing facility next to its existing 300mm fab (Fab12i) in Singapore. The first phase of this greenfield fab will have a monthly capacity of 30,000 wafers with production expected to commence in late 2024.

The new fab (Fab12i P3) will be one of the most advanced semiconductor foundries in Singapore, providing UMC’s 22/28nm processes. The planned investment for this project will be US$5 billion.

https://www.umc.com/en/News/press_release/Content/corporate/20220224-1The new fab is backed by customers who have signed multi-year supply agreements in order to secure capacity from 2024 and beyond, which points to robust demand outlook for UMC’s 22/28nm technologies for years to come, driven by 5G, IoT, and automotive mega-trends. Specialty technologies to be manufactured in the new facility, such as embedded high voltage, embedded non-volatile memory, RF-SOI, and mixed signal CMOS, are critical for a broad range of applications, including smartphones, smart home devices, and emerging electric vehicle applications.

Over 250 million euros for new manufacturing facilities

- Bosch chairman Stefan Hartung: “This investment will benefit our customers and help combat the crisis in the semiconductor supply chain”.

- New investment comes on top of 400 million euros of capital expenditure already earmarked for expansion of global semiconductor production in 2022.

- Extension is response to growing demand for Bosch semiconductors and MEMS sensors.

In October 2021, Bosch announced it would be spending more than 400 million euros in 2022 alone on expanding its semiconductor operations in Dresden and Reutlingen, Germany, and in Penang, Malaysia. Around 50 million euros of this sum is earmarked for the wafer fab in Reutlingen. In addition, Bosch also announced plans to invest a total of 150 million euros in the creation of additional clean-room space in existing buildings at the Reutlingen facility over the period from 2021 to 2023.

More than a quarter of a billion euros is to be invested in creating new production space and the necessary clean-room facilities between now and 2025.

https://www.bosch-presse.de/presspo...onductor-production-in-reutlingen-237952.htmlThe construction of a new extension in Reutlingen will create an additional 3,600 square meters of ultramodern clean-room space. As of 2025, this additional capacity will produce semiconductors based on technology already in place at the Reutlingen plant.

https://www.reuters.com/breakingviews/ukraine-war-flashes-neon-warning-lights-chips-2022-02-24/Ukraine war flashes neon warning lights for chips

MILAN, Feb 24 (Reuters Breakingviews) - Russia’s invasion of Ukraine read more by land, air and sea risks reverberating across the global chip industry and exacerbating current supply-chain constraints. Ukraine is a major producer of neon gas critical for lasers used in chipmaking and supplies more than 90% of U.S. semiconductor-grade neon, according to estimates from research firm Techcet. About 35% of palladium, a rare metal also used for semiconductors, is sourced from Russia. A full-scale conflict disrupting exports of these elements might hit players like Intel , which gets about 50% of its neon from Eastern Europe according to JPMorgan.

The pain won’t fall evenly. ASML (ASML.AS), which supplies machines to semiconductor makers, sources less than 20% of the gases it uses from the crisis-hit countries. Companies may turn to China, the United States and Canada to boost supplies, says JPMorgan. But this may be a slow path. Although the chipmaking industry was able to manage an increase in neon prices stemming from the 2014 Crimean crisis, the scale of today’s conflict looks much larger. (By Lisa Jucca)

EXCLUSIVE Russia's attack on Ukraine halts half of world's neon output for chips

WASHINGTON, March 11 (Reuters) - Ukraine's two leading suppliers of neon, which produce about half the world's supply of the key ingredient for making chips, have halted their operations as Moscow has sharpened its attack on the country, threatening to raise prices and aggravate the semiconductor shortage.

Some 45% to 54% of the world's semiconductor-grade neon, critical for the lasers used to make chips, comes from two Ukrainian companies, Ingas and Cryoin, according to Reuters calculations based on figures from the companies and market research firm Techcet. Global neon consumption for chip production reached about 540 metric tons last year, Techcet estimates.

Both firms have shuttered their operations, according to company representatives contacted by Reuters, as Russian troops have escalated their attacks on cities throughout Ukraine, killing civilians and destroying key infrastructure.

Before the invasion, Ingas produced 15,000 to 20,000 cubic meters of neon per month for customers in Taiwan, Korea, China, the United States and Germany, with about 75% going to the chip industry, Nikolay Avdzhy, the company's chief commercial officer, said in an email to Reuters.

The company is based in Mariupol, which has been under siege by Russian forces.

Cryoin, which produced roughly 10,000 to 15,000 cubic meters of neon per month, and is located in Odessa, halted operations on Feb. 24 when the invasion began to keep employees safe, according to business development director Larissa Bondarenko.

Bondarenko said the company would be unable to fill orders for 13,000 cubic meter of neon in March unless the violence stopped. She said the company could weather at least three months with the plant closed, but warned that if equipment were damaged, that would prove a bigger drag on company finances and make it harder to restart operations quickly.

"The largest chip fabricators, like Intel, Samsung and TSMC, have greater buying power and access to inventories that may cover them for longer periods of time, two months or more," she said. "However, many other chip fabs do not have this kind of buffer," she added, noting that rumors of companies trying to build up inventory have begun to circulate. "This will compound the issue of supply availability.”

https://www.reuters.com/technology/...eon-output-chips-clouding-outlook-2022-03-11/Bondarenko says prices, already under pressure after the pandemic, had climbed by up to 500% from December. According to a Chinese media report that cited Chinese commodity market information provider biiinfo.com, the price of neon gas (99.9% content) in China has quadrupled from 400 yuan/cubic meter in October last year to more than 1,600 yuan/cubic meter in late February.

“Global sales in January increased by more than 20% for the tenth consecutive month on a year-to-year basis, and sales into the Americas increased by 40.2% year-to-year in January to lead all regional markets,” said SIA president and CEO John Neuffer.

Semiconductor industry capex is also expected to rise as demand for chips also increases, according to IC Insights. Data shows capital spending within the industry is forecasted to jump by 24 percent, bringing in a total of $190.4 billion; an overall increase of 84 percent compared to three years ago.

“Booming demand has pushed most fabrication facility utilization rates well above 90% with many of the semiconductor foundries operating at 100% utilization. With such strong utilization rates and the expectations of continued high demand, the combined semiconductor industry capital spending in 2021 and 2022 is forecast to reach $344.3 billion,” said IC Insights in its latest research bulletin.

https://www.eetimes.com/semiconductor-sales-to-increase-26-8-percent-yoy-in-2022/“It is interesting to note that the big three memory suppliers (i.e., Samsung, SK Hynix, and Micron) are not on the list while the top three pure-play foundries (TSMC, UMC, and GlobalFoundries) are included,” IC Insights said. “Moreover, illustrating the diversity of the listing, four of the top five leading analog IC suppliers (TI, Analog Devices, Infineon, and ST) are scheduled to significantly ramp up spending in 2022.”

Qual é essa empresa?Espero que agora com os 11.000 milhões que vão dar, aqui a "minha" amkor PT cresça!

É esta https://goo.gl/maps/fFwkJN8XDphyE1Bt6Qual é essa empresa?