A despropósito:

https://twitter.com/KOMACHI_ENSAKA/status/1340526846530621442From HPE Cray Shasta Slide.

2020 : AMD Milan + Nvidia Volta Next : Perlmutter.

2021 : AMD Trento + AMD MI200 : Frontier.

2022 : Intel Sapphire Rapids + Intel Ponte Vecchio : Aurora.

2023 : AMD Genoa + AMD Next-Gen : El Capitan.

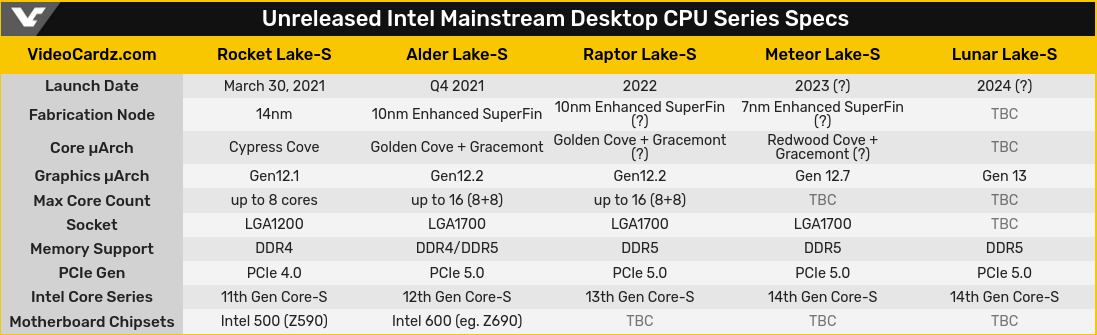

Eu escrevi Comet em vez de Meteor

Eu escrevi Comet em vez de Meteor