You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Processador Intel CPU 2018-2021 Roadmap Leaks Out

- Autor do tópico muddymind

- Data Início

Diria que até faz mais sentido do ponto de vista financeiro, afinal de contas começa a ser difícil de justificar os massivos investimentos nas suas Fab quando têm de contratar o fabrico dos seus produtos à TSMC.

Nemesis11

Power Member

Se estou a perceber bem, na próxima geração de servidores, a Intel diz "adeus" aos Chipsets (PCH)?

Se sim, optimo.

Custa-me a crer é que que só tenham 8 canais de memória, a não ser que esperem que os Clientes que precisem de mais bandwidth, o façam via placas CXL, como esta.

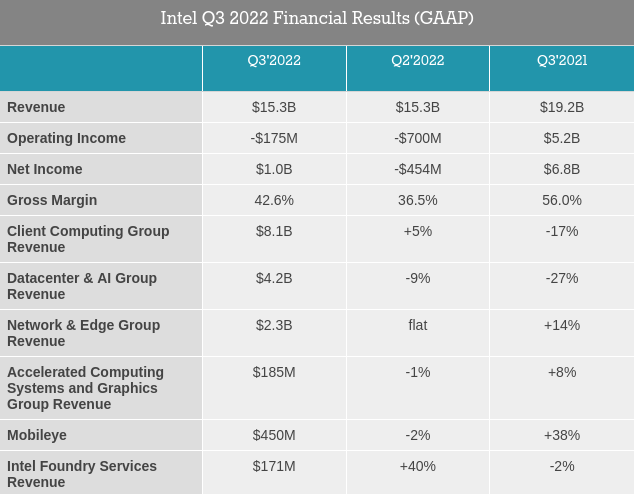

Intel Reports Q3 2022 Earnings: Back To Profitability, But Still Painful

For the third quarter of 2022, Intel reported $15.3B in revenue, a $3.9B decline versus the year-ago quarter. Compared to Intel’s hash Q2 report, the company has returned to profitability, booking a cool billion dollars in net income, though this is still well below their historical norms. In fact, the company is still operating at a (GAAP) loss, booking an operating income of -$175M. For Q3 at least, it would appear that it’s Intel’s tax situation that’s pushing them into the black, with the company recording a $1.2B tax benefit.

With that said, after the hit Intel took in Q2, the company does appear to be turning the corner, if slowly. Gross margins have improved to 42.6%, which although still below Intel’s historical (or even recent) average, is at least high enough to keep the company’s operating income close to positive figures.

These figures also reflect some one-off charges, in particular a $664M restructuring charge that Intel is taking now in order to reduce ongoing costs (i.e. layoffs). We’ll go more into Intel’s future projections and actions a bit later on, but in short, while Intel is likely to have seen the worst of things on their end, Intel is once again reducing their revenue projections for the year as the bust cycle that the entire PC industry is going through isn’t over yet.

Starting as always with the CCG, Intel’s client group booked $8.1B in revenue, which is down 17% from the year-ago quarter. The most exposed to the collapse of the consumer market, CCG has been impacted by OEMs ordering fewer chips thanks to their own large inventories, as consumer and education system sales slow. Operating margins are also similarly down, due to a mix of lower revenues to book costs against and Intel’s continued investments in product development.

https://www.anandtech.com/show/1762...earnings-back-to-profitable-but-still-painfulAs for Intel’s Data Center and AI group (DCAI), the company took an even larger revenue hit there. For Q3 Intel booked $4.2B in DCAI revenue, down 27% from the year-ago quarter.

This drop in revenue has all but wiped out the operating profitability of the group, with Intel recording an operating income of $0.0B and an operating margin of 0% for the group. Intel is attributing the drop to lower sales of server/AI parts as customer demand weakens, while Intel’s relative costs go up as more and more server processors are shipped on the Intel 7 and 10ESF processes.

Nemesis11

Power Member

Nada de muito novo, mas a Intel mostrou um novo diagrama dos Falcon Shores.

Este é o projecto que a Intel tem para, no mesmo package, colocar CPUs, GPUs, Custom Cores, memória rápida, etc.

O objectivo também é aumentar em 5 vezes a performance/watt, densidade e capacidade de memória.

Neste novo diagrama dá para ver que além da memória integrada no package, terá ligação a memória externa.

Este é o projecto que a Intel tem para, no mesmo package, colocar CPUs, GPUs, Custom Cores, memória rápida, etc.

O objectivo também é aumentar em 5 vezes a performance/watt, densidade e capacidade de memória.

Neste novo diagrama dá para ver que além da memória integrada no package, terá ligação a memória externa.

Nemesis11

Power Member

Alegadamente:

Pontos interessantes para o mercado consumidor:

Pontos interessantes para o mercado sevidor:

Outros:

Pontos interessantes para o mercado consumidor:

- Meteor Lake será um produto pensado mais para o mercado mobile. Actualmente tem problemas de yelds, mas não é devido ao processo de fabrico "Intel 4", mas devido a packaging e bugs no design.

- Granite Rapids Workstation = 2 Compute Dies 44 Cores Redwood Cove+ (1 ou mais cores desactivados) + 1 IO Die. 6 canais de memória. Têm esperança que atinja 5 Ghz+ em Turbo. Pode vir a ser reduzido para 1 Compute Tile. On schedule para 2024.

- Redwood Cove (P Core do Meteor Lake) = +15 a 25% IPC em relação ao Raptor Cove actual.

- Granite Rapids irá usar uma evolução do Redwood Cove, com o nome Redwood Cove+, que usa "Intel 3" em vez de "intel 4", no processo de fabrico.

Pontos interessantes para o mercado sevidor:

- Emerald Rapids é uma pequena evolução do Sapphire Rapids e tem 64 Cores.

- Granite Rapids = 132 Cores Totais com 4 cores desactivados. 3 Compute Dies de 44 Cores + 2 IO dies. 12 Canais de memória DDR5. CXL Gen2. Pci-Ex Gen5. Versões com HBM. 1H 2024. On schedule.

- No Granite Rapids, os Compute dies usam "Intel 3". IO die usam "Intel 7".

- Sierra Forest = 344 Cores "Little Cores", com 4 Compute dies de 86 Cores cada. É possível que exista uma versão com 528 Cores total (132 Cores por Compute die), 512 activos, com 1 Cluster desactivado por cada die. (Nos Little Cores 1 Cluster = Grupo de 4 Cores).

- Diamond Rapids sucessor do Granite Rapids. Clearwater Forest sucessor do Sierra Forest.

- Diamond Rapids ainda é um design iniciado pelo Jim Keller. Parece ser um design radicalmente diferente dos anteriores.

- Objectivo da Intel = Igualar o AMD Turin com o Granite Rapids. Ultrapassar a AMD com o Diamond Rapids.

Outros:

- Parece que, actualmente, os problemas não estão nas Foudries da Intel, mas na parte de design.

- As Foundries da Intel estão a tratar as equipas de design internas como se fossem clientes externos.

- É possível que as Foundries da Intel venham a produzir produtos de empresas concorrentes.

Nemesis11

Power Member

Socket LGA-7529, do Intel Sierra Forrest.

https://twitter.com/yuuki_ans/with_replies

https://h5.m.goofish.com/item?id=699219966207

https://h5.m.goofish.com/item?id=698896997276

12 Canais de memoria e um socket um pouco grande.

https://twitter.com/yuuki_ans/with_replies

https://h5.m.goofish.com/item?id=699219966207

https://h5.m.goofish.com/item?id=698896997276

12 Canais de memoria e um socket um pouco grande.

Nemesis11

Power Member

Intel Cuts Pay For Employees To Keep Their Quarterly Dividend

Hot off the presses, we have confirmation from multiple employees that Intel is cutting costs tremendously at the expense of their employees. These cuts are broad-based, with employees having their compensation affected. Quarterly pay bonuses are gone, annual bonuses are being paused, 401k match is halved from 5% to 2.5%, merit-based raises are suspended, and there is a pay cut to all employees’ base salary based on grade.

All employees below Principal Engineer, grades 7 to 11, will get a 5% cut, 10% cuts will be instituted for VPs, and the executive leadership team will take a 15% cut, with Pat Gelsinger taking a 25% cut. These cuts hurt even more when we are in an inflationary environment.

These cost cuts are, of course, dwarfed by their quarterly dividend, of course, which we have been clamoring for them to cut for over a year.

We are sorry to all employees of Intel about this and hope they can make it through this tough time. Other firms are still hiring despite the macroeconomic conditions, although at a slower pace than before. This was an incredibly dumb move, as employees will become “quiet quitters” and lose morale. Bonus cuts are 1 thing, but base pay cuts sting. Intel, unfortunately, has to cut costs dramatically due to its immense amount of cash being burned, but they are doing it in the worst way.

High performers likely start to “phone it in” while they look for their next job, as there is no incentive to keep working long nights and early mornings. The level 7 cut-off point is too low. This includes some fresh advanced graduates and many normal graduates with a handful of years of experience.

https://www.semianalysis.com/p/intel-cuts-pay-for-employees-to-keepIn October, we discussed the comprehensive supply chain review that Intel was instituting to cut costs. Since then, Intel has cut an R&D center in Israel, started laying off thousands, cut their RISC-V accelerator program, ended development of networking switches, delayed construction on the Germany Fab, slowed Ohio fab tool orders, and cut capital expenditures by billions.

We will leave you with our rant from July of 2022 after Intel cut fab buildout by $4B to keep the dividend.

Entre o lançamento do Skylake e do Ice Lake, quando a Intel passou pelos problemas de desenvolvimento dos 10 nm, as contas da Intel estavam bastante saudáveis, mas em vez de investir mais no futuro, em poucos anos, pagaram várias dezenas de mil milhões de $, em dividendos e stock buybacks, aos accionistas.

Agora que a Intel está a sofrer as consequências desses problemas e as contas foram ao charco, reduzem investimentos, cancelam produtos anunciados recentemente, acabam com divisões inteiras, anunciam despedimentos em massa e, num ambiente de inflação alta, reduzem salários e acabam com bónus. A única coisa que não cortam é nos dividendos para os accionistas.

Acho isto extremamente bizarro, numa empresa em crise e que se encontra num sector onde o talento é muito importante e onde os valores em investimento são enormes.

Última edição:

igorcoelho

Power Member

https://www.semianalysis.com/p/intel-cuts-pay-for-employees-to-keep

Entre o lançamento do Skylake e do Ice Lake, quando a Intel passou pelos problemas de desenvolvimento dos 10 nm, as contas da Intel estavam bastante saudáveis, mas em vez de investir mais no futuro, em poucos anos, pagaram várias dezenas de mil milhões de $, em dividendos e stock buybacks, aos accionistas.

Agora que a Intel está a sofrer as consequências desses problemas e as contas foram ao charco, reduzem investimentos, cancelam produtos anunciados recentemente, acabam com divisões inteiras, anunciam despedimentos em massa e, num ambiente de inflação alta, reduzem salários e acabam com bónus. A única coisa que não cortam é nos dividendos para os accionistas.

Acho isto extremamente bizarro, numa empresa em crise e que se encontra num sector onde o talento é muito importante e onde os valores em investimento são enormes.

que loucura

pior é que continuar assim não sei não....

pior é que continuar assim não sei não....erdnagama

Power Member

Em empresas publicamente cotadas em bolsa é assim que funciona e sempre funcionará. Não trabalham para a sustentabilidade a médio longo prazo, é tudo canalizado para o melhor resultado possível no próximo semestre.

Tudo isto parece irracional e contra-producente, mas a lógica é muito clara, tudo para manter a trajectória de valorização das acções. Paralelamente o mercado reage logo muito positivamente a despedimentos em massa, valorizam logo as acções.

Tudo isto parece irracional e contra-producente, mas a lógica é muito clara, tudo para manter a trajectória de valorização das acções. Paralelamente o mercado reage logo muito positivamente a despedimentos em massa, valorizam logo as acções.

Nemesis11

Power Member

Mais umas fotos do Socket LGA-7529.

O Socket parece que é 1.7X maior que o actual Socket LGA-4677.

Se estou a ver bem, nesta Board estão 25 Conectores MCIO 4X, 1 Conector MCIO 8X, 2 Conectores MCIO 16X, 1 Conector MCIO 20X e 2 Slots Pci-Ex 16X. Se estiver correcto, só nestes conectores/slots estão 192 Lanes Pci-Ex.

O Socket parece que é 1.7X maior que o actual Socket LGA-4677.

Se estou a ver bem, nesta Board estão 25 Conectores MCIO 4X, 1 Conector MCIO 8X, 2 Conectores MCIO 16X, 1 Conector MCIO 20X e 2 Slots Pci-Ex 16X. Se estiver correcto, só nestes conectores/slots estão 192 Lanes Pci-Ex.

Última edição:

Nemesis11

Power Member

https://lore.kernel.org/lkml/[email protected]/Remove Thunder Bay specific code as the product got cancelled and there are no end customers or users.

Mais um produto cancelado. O Intel Thunder Bay era um SOC com CPU x86 e VPU (Visual Processing Unit) da Movidius. Seria para sucesseder ao actual produto, que usa Cores ARM. Não me admirava se o sucessor (se houver), continuasse a ser ARM.

Seja como for, continua o cancelamento de produtos e projectos menos essenciais.

500w

https://videocardz.com/newz/intels-...latform-detailed-supports-up-to-500w-tdp-cpus

Intel’s next-gen Xeon “Avenue City” reference platform detailed, supports up to 500W TDP CPUs

Intel Avenue City is a new platform for upcoming Granite Rapids and Sierra Forest data-center CPUs.

The next-step is an entirely new platform based on the LGA-7529 socket. Hardware leaker YuuKi-AnS revealed that this platform will power the next-gen Granite Rapids (GNR) and Sapphire Forest (SRF-AP) series. This platform is set to launch next year with even more powerful CPUs and even faster DDR5 memory.

It appears that the validation platform for these Xeon series has now been named as “Avenue City *****”. This is the first confirmation that future Xeon CPUs may launch with 500W TDP, as the platform supports such power:

https://videocardz.com/newz/intels-...latform-detailed-supports-up-to-500w-tdp-cpus

Nemesis11

Power Member

Se aquele "6x16" que está no Slide referir-se a Pci-Ex, então o total são 96 lanes.Although the slide does not explicit mention PCIe lane support for the CPU, it would appear that at least 80 lanes are available for each processor. Each CPU should support 80, a same number as Eagle Stream, however this may not be a final spec for this platform.

Uma coisa que me saltou à vista. Eles dividem o IO, de cada um dos Processadores, entre "North" e "South", sendo que a "South" parece ter 32 Lanes e a "North" parece ter 64 Lanes (As tais 96 Lanes totais). Não me lembro de ver uma distinção destas noutro Processador. Confirmação das 2 IO dies?

Também não faço ideia o que seja aquele "Self Boot Support".

Já agora, parabéns a quem se lembrou de dar o nome "RunBMC" ao módulo com a BMC que está na Board.

Última edição:

muddymind

1st Folding then Sex

Nemesis11

Power Member

Via photoshop, comparação com um LGA1700:

A partir do momento que um CPU tem o comprimento de um DIMM, não sei como vão fazer no futuro. Ainda no outro dia lia que nas Boards com os ultimos Epyc, os slots de plástico dos DIMMs são "slim" e tem que se ter cuidado para não os danificar.

Talvez soldando o Chip a um PCB, que depois se coloca numa Daughterboard, como a nVidia tem nos CPUs e GPUs datacenter.

RIP.Gordon Moore

Nemesis11

Power Member

Continuam os cortes do lado da Intel. Parece que vão desfazer-se da parte de WWAN para a Fibocom e Mediatek, sem retorno financeiro.

Era esperado que a Intel continuasse a fazer cortes em divisões menos rentáveis e prioritárias. Estes cortes devem continuar no futuro próximo.

Intel to Exit Cellular Modem Business

5G Support Goes to MediaTek

For the 5G modems, Intel sold its ‘Intel Communications and Devices Group’ (CDG) business to Apple in a $1 billion deal back in 2019. CDG was derived from Intel’s purchase of Wireless Solutions from Infineon in early 2011 for $1.4 billion. The 2019 deal with Apple meant that Apple obtained most of Intel’s 5G modem IP, related product teams, equipment, and property leases. Apple has been working with the IP gained in that deal to develop its own 5G modem – which has not yet hit the market. The deal only covered smartphone modems – Intel retained critical IP and the option to build modems for PCs, embedded markets, autonomous driving, infrastructure, and other verticals.

Since the deal, Intel has been working on two fronts – maintaining its 4G modem business, alongside its supplier Fibocom Wireless, and as of 2021 Intel has been working with MediaTek to bring 5G to PCs. This means leveraging the modems MediaTek and Fibocom have developed, along with driver stacks from Intel, and also leveraging Intel’s multi-year relationships with PC OEMs, OSVs, and wireless carriers.

However, we have since learned that Intel is now set to exit all of its Client and Commercial WWAN / Cellular Modem business for PCs.

For those following Intel of late, this might not be a shock. As part of Intel’s growth strategy in manufacturing, and the recent macroeconomic climate, Intel has been looking to exit certain businesses which have not been overly beneficial to the balance sheet. The WWAN business is one of those.

According to our sources, Intel believes the total addressable market (the financial size of the ‘modem-enabled PC’ market overall) hasn’t grown in ten years – but perhaps more importantly whenever Intel has had sustained revenue, that revenue has had negative margin associated with it.

For the 5G business with MediaTek, Intel will undertake a technology transfer to Fibocom and MediaTek, and is in the process of enabling driver code, licensing agreements, and as much as they can to maintain the customer experience. Intel will keep a small team onboard to assist MediaTek, who intend to remain in the business. The technology transfer is expected to be completed sometime in May, and by July, Intel is expected to have left the 5G market altogether. The technology transfer to Fibocom and Mediatek isn’t expected to be financial to Intel, either positive or negative.

For the 4G business, Intel will start the process for end-of-life of their 4G modem portfolio. As mentioned before, Fibocom is the main partner here, and the last shipments to Fibocom are expected to occur in late 2025, depending on orders.

https://morethanmoore.substack.com/p/intel-to-exit-cellular-modem-businessSimply put, this is Intel doing additional cost cutting to a business that was costing some money and not really making any money. For the profit and loss sheet, this will all fall under Intel’s Client Computing Group (CCG), however the costs to the business unit were around tens of millions per year, so we’re not expecting to see a significant change on next financial statement. From the Wireless Solutions Group at Intel, this WWAN division was around 20% of the personnel, including both product marketing and engineering.

Era esperado que a Intel continuasse a fazer cortes em divisões menos rentáveis e prioritárias. Estes cortes devem continuar no futuro próximo.